Struggling to keep track of your credit card rewards? AI tools can simplify the process, helping you maximize points, cashback, and other perks. Here's a quick rundown of the top 7 AI-powered tools that can help you manage and optimize your rewards:

- CreditCaptain: Focuses on improving your credit score to unlock premium cards with better rewards.

- MaxRewards: Syncs with your accounts to track balances, bonuses, and expiration dates.

- Birch Finance: Uses machine learning to analyze spending and recommend the best cards for your habits.

- Wallaby: Suggests the best card for each purchase and supports international transactions.

- CardPointers: Offers basic reward tracking but lacks detailed insights.

- AwardWallet: Tracks rewards but lacks transparency on features like multi-account integration.

- Reward Summit: Limited information on its AI features; better options may be available.

Quick Tip: Look for tools with strong security, seamless integration, and automation to make the most of your rewards. Evaluate costs versus benefits to ensure the tool aligns with your financial goals.

Quick Comparison

| Tool | Key Feature(s) | Focus Area | Cost (if applicable) |

|---|---|---|---|

| CreditCaptain | Credit score improvement, premium cards | Credit building | $149–$299/month |

| MaxRewards | Tracks bonuses, balances, expiration dates | Reward management | Free and premium plans |

| Birch Finance | Spending analysis, tailored card suggestions | Spending optimization | Free and premium plans |

| Wallaby | Purchase-specific card suggestions | Reward optimization | Free |

| CardPointers | Basic reward tracking | Simplicity | Free |

| AwardWallet | Multi-account rewards tracking | Reward tracking | Free and premium plans |

| Reward Summit | Limited AI-based reward tracking | Basic reward tracking | Free |

Bottom Line: Choose a tool that matches your credit card portfolio and spending habits for the best results. AI tools make managing rewards easier, but the right choice depends on your personal goals.

MaxRewards App Review: Best Credit Card Management App?

1. CreditCaptain

CreditCaptain focuses on improving your credit score rather than directly tracking rewards. By enhancing your credit profile, it helps you qualify for premium credit cards with better rewards. The platform uses AI to analyze your credit report, identifying areas to improve, which can result in lower interest rates and access to superior credit options.

Its AI-driven system highlights actionable steps to boost your credit score, opening doors to better credit card offers and reward programs.

Here’s a breakdown of CreditCaptain's subscription plans:

| Plan | Monthly Price | Key Features |

|---|---|---|

| Basic | $149 | Live score dashboard, Score analysis, $1M ID theft protection |

| Pro | $199 | AI credit score monitoring, Goal-oriented growth, CreditCaptain Boost™ |

| Turbo | $299 | Pre-approved financing offers, Dedicated account manager |

The service also offers a 90-day money-back guarantee if your credit score doesn’t improve, making it a low-risk option for those looking to enhance their credit profile.

CreditCaptain focuses on building a strong credit foundation, setting you up for access to premium credit card perks.

2. MaxRewards

MaxRewards focuses on helping users get the most out of their credit card rewards. By syncing directly with credit accounts, it tracks balances and analyzes spending patterns to identify opportunities for better reward usage.

The platform offers different membership levels. Premium plans include advanced features like detailed tracking, personalized bonus activations, and real-time notifications. The user-friendly dashboard keeps all your rewards, bonus progress, and expiration dates in one place, making it easier to plan your spending.

With MaxRewards, managing and maximizing your credit card benefits becomes simpler and more efficient.

3. Birch Finance

Birch Finance stands out by analyzing your spending habits to help you get the most out of your credit card rewards. Using machine learning, it reviews your transaction history and provides tailored recommendations to maximize points or cashback.

The platform categorizes your purchases and suggests the best credit cards for your spending patterns. For instance, if you dine out often, it might recommend a card with top-tier dining rewards. This categorization also lays the groundwork for tools that help you plan smarter spending.

By examining your past spending, Birch Finance predicts future expenses and advises which cards could offer better rewards for upcoming purchases. It even alerts you when switching to another card could earn you more points or cash.

The dashboard gives you an at-a-glance view of your rewards, showing balances for points or miles, their estimated value, monthly trends, and any missed opportunities.

Birch Finance works with many major credit card issuers, making it simple to manage multiple accounts in one place. It’s especially useful for people juggling several rewards cards, as it eliminates the hassle of manually tracking spending categories and bonus rates.

For those looking for extra features, the premium tier offers advanced insights and strategies tailored to your spending. However, if improving your credit score is your main goal, a service like CreditCaptain might be a better fit.

sbb-itb-b2789ac

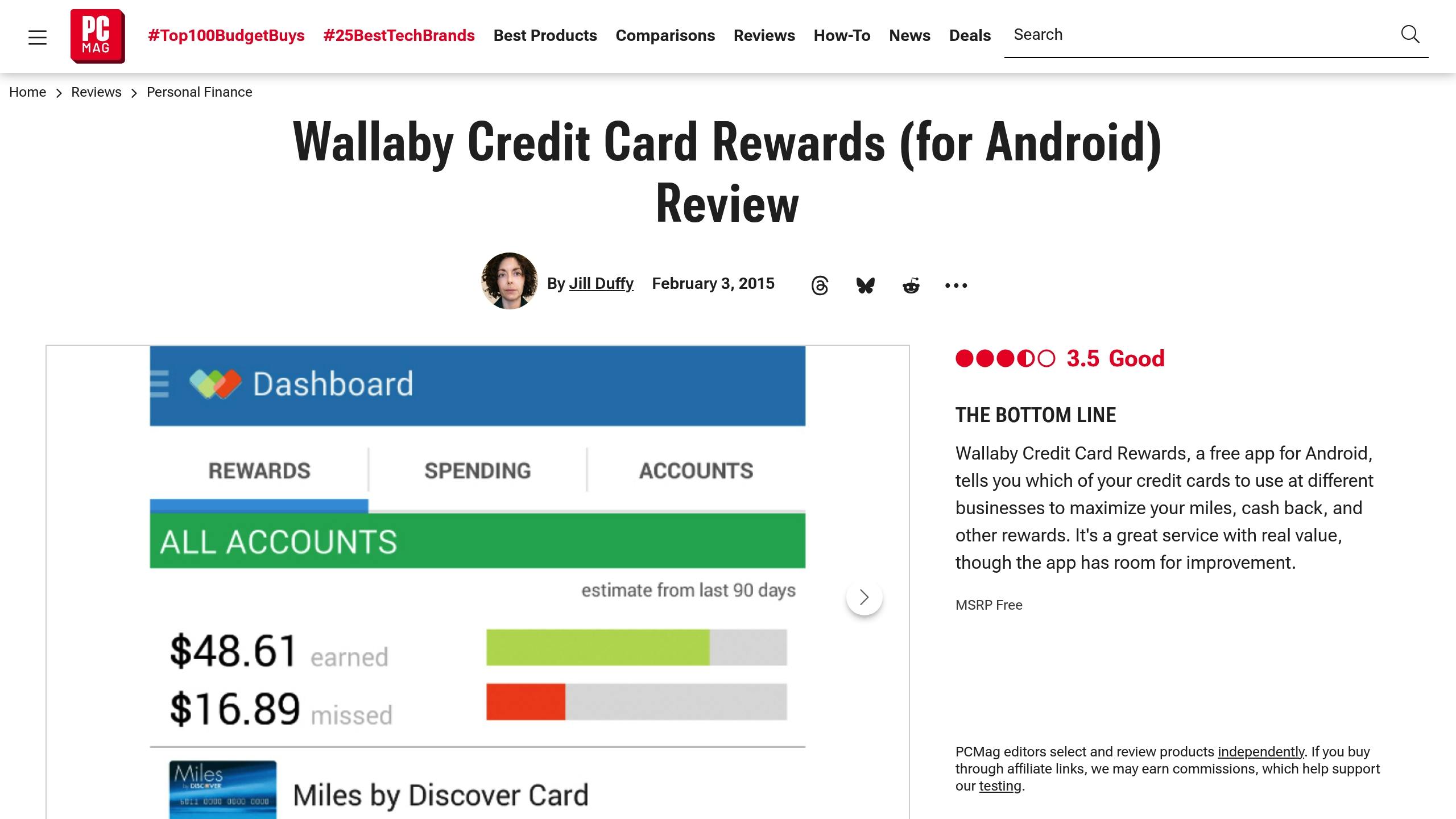

4. Wallaby

Wallaby is an AI-powered tool designed to help users make the most of their credit card rewards. Available as a mobile app and through a web interface, it simplifies the process of maximizing rewards. The platform analyzes your spending habits and suggests the best credit card to use for each purchase. Its dashboard provides a clear summary of your rewards and pinpoints areas where you could earn more.

For those who frequently make purchases abroad, Wallaby can also help optimize rewards on international transactions. However, if improving your credit score is your main goal, you might want to explore alternatives like CreditCaptain.

5. CardPointers

CardPointers takes a different approach compared to Wallaby. Information about its features is somewhat sparse. While many tools focus on extensive tracking and maximizing rewards, CardPointers seems to offer fewer insights. It's also unclear whether it suggests specific credit cards to help users get the most rewards for their purchases. Before committing, users should assess whether CardPointers aligns with their needs or consider other tools with more comprehensive features.

6. AwardWallet

AwardWallet provides an AI-powered platform for tracking rewards, but it doesn't offer much clarity on how it handles multi-account integration or security measures. To get a better understanding, reach out to AwardWallet's support team for specifics on these features. It’s also worth comparing it to tools with more transparent documentation to see if it aligns with your requirements. For a different take on reward tracking, you might want to check out Reward Summit.

7. Reward Summit

Reward Summit is the last tool we'll mention here, but its AI features aren't well-documented publicly. The platform provides only limited and unverified information about its AI-powered reward tracking.

When choosing tools like this, it's smart to prioritize those that are upfront about their AI capabilities. Look for ones that offer:

- Clear explanations of how AI is used

- Transparent details about features

- Regular updates to improve functionality

- Thorough and accessible documentation

These factors can help you pick a tool you can trust to manage and maximize your credit card rewards effectively.

Conclusion

Choosing the right AI tool can simplify your rewards strategy, especially as credit card rewards programs become increasingly intricate. AI-driven tracking tools are now a must-have for getting the most out of your rewards.

Here are a few key factors to keep in mind:

- Security Features: Opt for tools with strong protections like bank-level encryption, two-factor authentication, and secure data handling.

- Integration Capabilities: Make sure the platform connects effortlessly with major credit card issuers.

- Automation: The best tools handle reward tracking, category optimization, and real-time notifications automatically.

- Cost vs. Value: Some tools require a subscription for premium features, but many offer free options that work well for casual users. Evaluate whether the rewards you’ll gain outweigh the cost of the tool.

These considerations help ensure the tool fits your financial habits and goals.

From platforms like CreditCaptain to Reward Summit, AI tools have reshaped how we manage credit card rewards. They’ve moved beyond basic point tracking to analyzing spending patterns, empowering users to make smarter decisions.

The trick is picking a tool that matches your credit card portfolio and personal goals. Whether you’re a casual user or a rewards enthusiast, the right tool can make a big difference in how much you earn. Regular use and proper setup will help you get the most out of it. With AI technology advancing rapidly, even more sophisticated features are just around the corner.